main street small business tax credit sole proprietor

Fortunately sole proprietors can deduct half of their self-employment tax. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

Tax Tips For Entrepreneurs With New Small Businesses Next Avenue

Sole proprietorshipMain Street Small Business Tax Credit For the taxable year beginning on or after January 1 2020 and before January 1 2021 a Main.

. The most common and simplest form of business is a sole proprietorship. The Eileen Fisher Women-Owned Business Grant Program. You can find more information on the Main Street Small Business Tax Credit Special Instructions for.

The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. On November 1 2021 the California Department of Tax and Fee. Use Fill to complete blank online CALIFORNIA pdf forms for free.

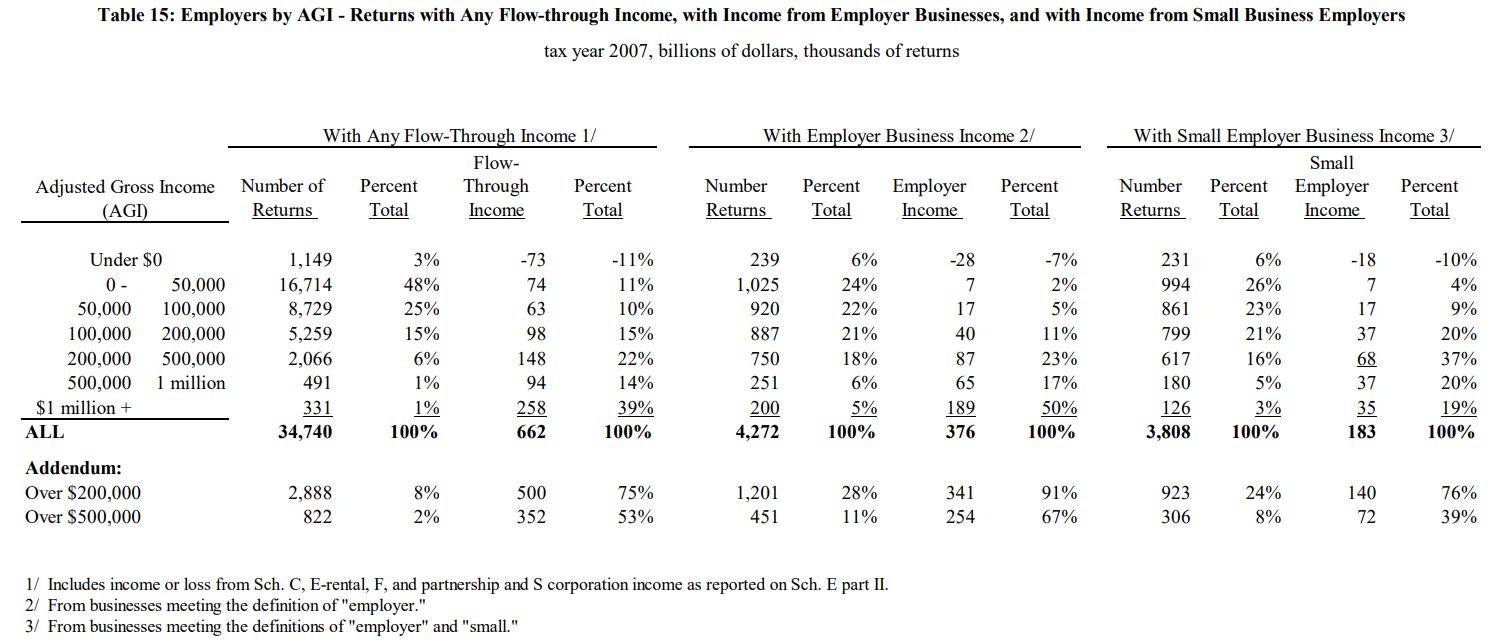

Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and. Many small businesses operating in the United States are sole proprietorships. This bill provides financial relief to qualified small businesses for the economic.

Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. A small business that is a sole proprietorship where the sole proprietor employs one or more persons during the tax year and the net small business income is greater than zero but less. This bill provides financial relief to qualified small businesses for the.

See reviews photos directions phone numbers and more for Sole Proprietorship locations in Albany NY. Heres how to get started. For 2021 you pay Social Security on your net self-employment earnings up to 142800 and Medicare tax on all earnings.

All forms are printable and downloadable. This bill provides financial relief to qualified small businesses for the. Once completed you can sign your fillable form or send for signing.

Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. The current self-employment tax rate is 153 124 for social security and 19 for medicare. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

Even if youre just starting a side business its important to make sure youre in compliance with any local or state. Eileen Fisher offers five grants annually to women owned businesses focused on creating environment and social change. MainStreet takes a holistic approach to small business management so you can grow your business smarter not harder.

Getting Less For More The S Corporation Association

White House Shortchanges Main Street The S Corporation Association

Us Tax Changes For Small Business Owners Expat Us Tax

Small Business Tax Credits The Complete Guide Nerdwallet

Small Business Tax Credits The Complete Guide Nerdwallet

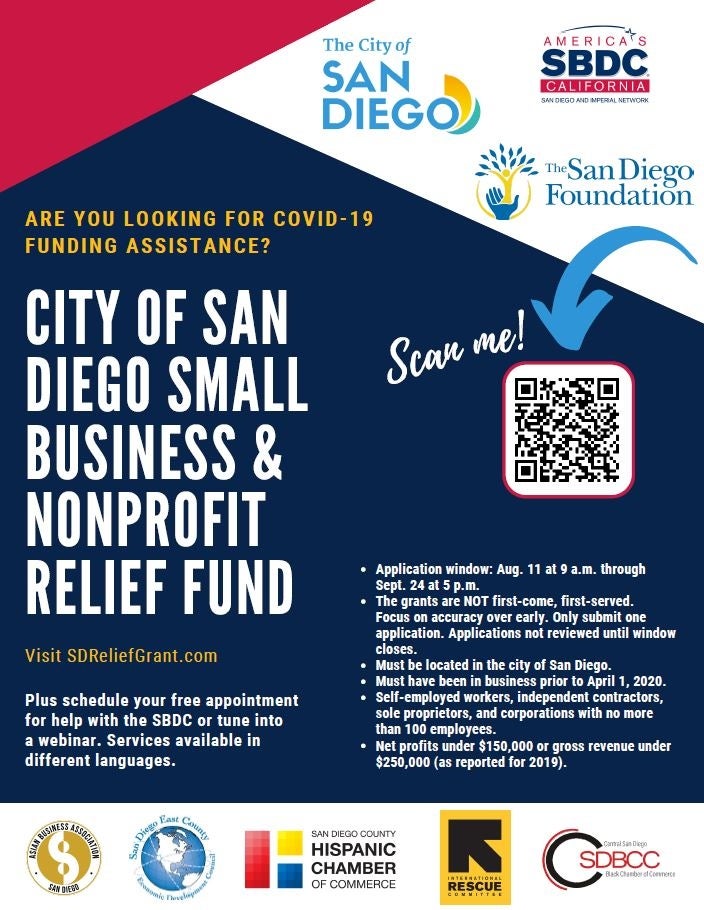

Business Relief And Support Economic Development City Of San Diego Official Website

California Main Street Small Business Tax Credit Ii First Come First Served By November 30 Marcum Llp Accountants And Advisors

Main Street Small Business Tax Credit Incentives Eligibility

Main Street Small Business Tax Credit Available For California Business Owners Sensiba San Filippo

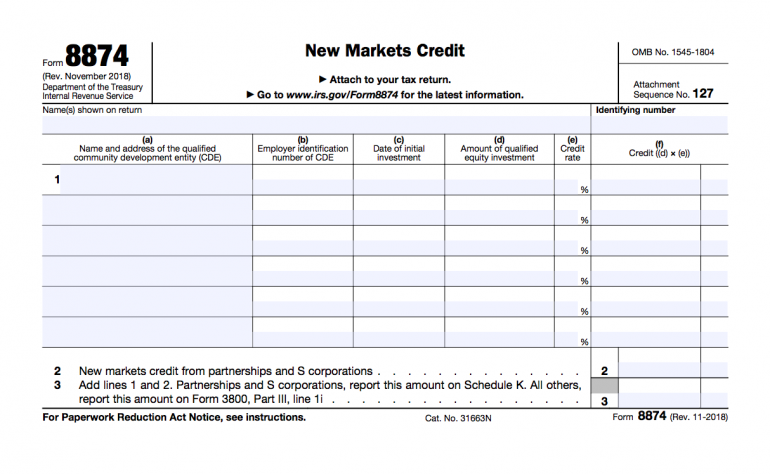

Small Business Tax Credits The Complete Guide Nerdwallet

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Financing And Incentives Njeda

Tax Reform For Small Businesses Nfib

Small Business Tax Credits The Complete Guide Nerdwallet

Mainstreet Rise Main Association For Enterprise Opportunity

To Save The Economy Policymakers Need To Know Small Business 101

Small Business Tax Credits The Complete Guide Nerdwallet

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank